Interest. Riba they call in Arabic. Is it something we can do without? Not a question thats commonly asked. What does the Quran say?

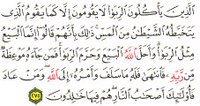

Translation :

Those who devour usury will not stand except as stands one whom the Evil One by his touch hath driven to madness.

That is because they say: "Trade is like usury

but Allah hath permitted trade and forbidden usury.

Those who after receiving direction from their Lord desist shall be pardoned for the past; their case is for Allah (to judge); but those who repeat (the offence) are companions of the fire:

they will abide therein (for ever).

That is because they say: "Trade is like usury

but Allah hath permitted trade and forbidden usury.

Those who after receiving direction from their Lord desist shall be pardoned for the past; their case is for Allah (to judge); but those who repeat (the offence) are companions of the fire:

they will abide therein (for ever).

Explanation: The Quran likens the money lender to a mad man. Just as one who is mentally retarded, looses his senses on account of a disordered intellect; similarly a money lender looses his mental balance for lust of money. He is so foolish and impudent that he does not mind cutting down the roots of human love, brotherhood and compassion for the sake of his own greed and avarice. He behaves as if he is crazy, and will be raised likewise in the Hereafter as each one would be risen in the condition he dies in this world.

The arabic word riba literally means increase in or addition to anything. Technically it applies to that sum which the creditor charges from the debtor at a fixed rate on the principal he lent.

At the time of revelation of the Quran interest was charged in several ways.

A) A person sold something and fixed a time limit for repayment. If the buyer failed to pay it within the fixed period then he was allowed more time but had to pay an additional sum.

B) A person lent a sum of money and asked the debtor to pay it back together with an additional sum of money within a fixed period.

C) A rate of interest was fixed for a specified period and if the principal along with the interest was not paid within that period ; then the rate of interest was increased for the extended period.

Those Arab money lenders did not see any difference between profit and interest. They argued as follows: When profit is lawful in trade, why should interest on money invested in loans be unlawful? They were not alone in putting forth this argument. The bankers and money lenders of today also say the same. They say that a person who lends a sum of money to another could himself make profit from it and the debtor does actually invest the loan in a profitable business. Why should not then the creditor get a share of that profit from the debtor for his productive credit? However they forget a simple fact. No business in this world can guarantee a fixed profit without the element of risk. Be it, trade, commerce, industry or agriculture: one has to expend labour and capital but also undertake some risk to make a profit.

There are 2 fundamental differences between interest and trade.

A) In trade, the settlement of profit between the buyer and the seller is made on equal terms.

The buyer purchases the article he needs and the seller gets a profit for his product or service and the time labour and intellect he expended for it.

From an economic point of view we find that there are 2 kinds of loans.

1) A personal loan that is taken by the helpless needy people for their own needs.

2) A business loan that is taken by business to finance trade industry etc

As far as the first kind is concerned we all know what ruinous results it produces. The money lenders and bankers suck the blood of labourers peasants and the common man making their condition exteremely deplorable. Even after paying interest that is many times the principal amount, they still remain in debt. A major portion of their income is taken by the money lender and it is difficult to make both ends meet. Naturally this kills their interest for work and some are even driven towards suicide. This selfish money lending leads to the fattening of a few at the expense of a vast under privileged majority resulting in general inefficiency and a lowering of the productivity of the nation. When the suppressed anger of these exploited masses reaches a crescendo, it erupts in the form of bloody revolutions that sweep away the life and honor of the upper class with all their ill-gotten wealth.

As far as the first kind is concerned we all know what ruinous results it produces. The money lenders and bankers suck the blood of labourers peasants and the common man making their condition exteremely deplorable. Even after paying interest that is many times the principal amount, they still remain in debt. A major portion of their income is taken by the money lender and it is difficult to make both ends meet. Naturally this kills their interest for work and some are even driven towards suicide. This selfish money lending leads to the fattening of a few at the expense of a vast under privileged majority resulting in general inefficiency and a lowering of the productivity of the nation. When the suppressed anger of these exploited masses reaches a crescendo, it erupts in the form of bloody revolutions that sweep away the life and honor of the upper class with all their ill-gotten wealth.

Some of the evils of usurious business loans are as follows:

a) Those who cannot afford to pay an interest rate higher than the market rate loose out on getting finance no matter how useful they may be for the nation. Whoever meets market rates of interest gets financed irespective of how ruinous or harmful it could be to the nation.

b) The usurious financer is only interested in his own fixed interest and is least concerned about the health of the business he has invested in. He therefore tries to withhold or withdraw his money at the slighest fear of slump in the market. This creates panic and market crashes.

An unbiased study of the above should convince anyone on the evils that are inherent in usury.

I will InshaAllah in later blogs delve deeper into this issue.

Lets take the case of a money lender giving out money on extremely low rates of interest to a businessman. The businessman devotes his time, labour, talent and even his personal funds to turn his business into a profitable venture. He works hard day and night, but even so is never sure that his labour will bear fruit and the business will net profits. Moreover he is exposed to different risks and problems like expected demand, inflation, supply of raw material and so many issues that are beyond his control. On the other hand the money lender who lends only his capital, goes on receiving a fixed amount of profit without undertaking any risks whatsoever. On which principles of economics, reason, logic and justice can this be justified?

There are 2 fundamental differences between interest and trade.

A) In trade, the settlement of profit between the buyer and the seller is made on equal terms.

The buyer purchases the article he needs and the seller gets a profit for his product or service and the time labour and intellect he expended for it.

B) In (an) interest (based transaction) the settlement of interest between the creditor and the debtor is always on unequal terms. The dice is always loaded in favour of the creditor. He always gets his fixed amount of interest which he terms his profit. The debtor however is completely exposed to the whims of market conditions, his own ability to manage labour capital and technology etc to produce and sell. He bears all business risks and is still not sure whether his business will return any fixed profits.

Profit and interest obviously produce totally different moral and economic results.

Let us first analyze from a moral perspective.

Profit and interest obviously produce totally different moral and economic results.

Let us first analyze from a moral perspective.

Interest is based on greed selfishness parsimony narrow mindedness and hard-heartedness. Thus an interest based society can never be strong and stable as it is selfishness that drives their mutual dealings and they are not willing to help each other if there is no materialistic benefit. If the rich believe that the poor merely exist to offer them an opportunity for exploitation then there will be a clash of interests and produce class struggle causing disintegration of society. On the other hand if the haves treat the have-nots with dignity respect compassion empathy and justice and are ready to base their transactions on generosity and sympathy, then society will become equitable strong and stable.

From an economic point of view we find that there are 2 kinds of loans.

1) A personal loan that is taken by the helpless needy people for their own needs.

2) A business loan that is taken by business to finance trade industry etc

As far as the first kind is concerned we all know what ruinous results it produces. The money lenders and bankers suck the blood of labourers peasants and the common man making their condition exteremely deplorable. Even after paying interest that is many times the principal amount, they still remain in debt. A major portion of their income is taken by the money lender and it is difficult to make both ends meet. Naturally this kills their interest for work and some are even driven towards suicide. This selfish money lending leads to the fattening of a few at the expense of a vast under privileged majority resulting in general inefficiency and a lowering of the productivity of the nation. When the suppressed anger of these exploited masses reaches a crescendo, it erupts in the form of bloody revolutions that sweep away the life and honor of the upper class with all their ill-gotten wealth.

As far as the first kind is concerned we all know what ruinous results it produces. The money lenders and bankers suck the blood of labourers peasants and the common man making their condition exteremely deplorable. Even after paying interest that is many times the principal amount, they still remain in debt. A major portion of their income is taken by the money lender and it is difficult to make both ends meet. Naturally this kills their interest for work and some are even driven towards suicide. This selfish money lending leads to the fattening of a few at the expense of a vast under privileged majority resulting in general inefficiency and a lowering of the productivity of the nation. When the suppressed anger of these exploited masses reaches a crescendo, it erupts in the form of bloody revolutions that sweep away the life and honor of the upper class with all their ill-gotten wealth.Some of the evils of usurious business loans are as follows:

a) Those who cannot afford to pay an interest rate higher than the market rate loose out on getting finance no matter how useful they may be for the nation. Whoever meets market rates of interest gets financed irespective of how ruinous or harmful it could be to the nation.

b) The usurious financer is only interested in his own fixed interest and is least concerned about the health of the business he has invested in. He therefore tries to withhold or withdraw his money at the slighest fear of slump in the market. This creates panic and market crashes.

An unbiased study of the above should convince anyone on the evils that are inherent in usury.

I will InshaAllah in later blogs delve deeper into this issue.

Click here to read what Riba/interest is doing to farmers of Maharashtra

0 Responses to “Its in no ones interest”

Post a Comment